Discover our Impact

Through a continuum of internally and externally integrated programs and services that focus on the whole individual, guests achieve stability in three key areas: housing, income, and behavioral health.

Attend an Event

We regularly host events to advocate for and support people who are experiencing homelessness and poverty. They are a great way to get involved, support and learn more about St. Francis House.

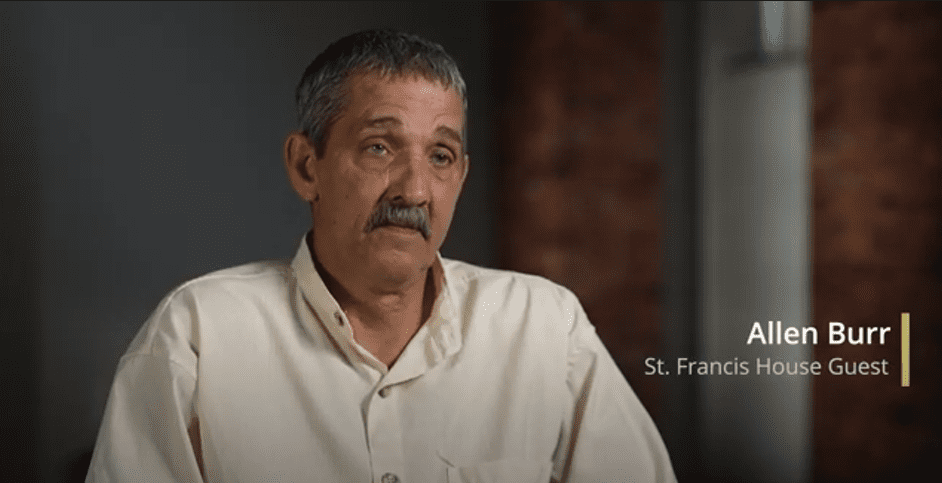

Hear Allen’s Story

Hear it from our community

Our guests are given the comprehensive and continuous support they need in order to rebuild their lives.